Canton Tax Group

CANTON TAX GROUP Outstanding Service

At Reasonable Rates

Personalized Service and Super Value at Canton Tax Group Exceeds Customer Expectations

E-mail Us Today

A Giant Step Above The National Chains

John Dobbyn (Enrolled Agent) has decades of experience working with all tax clients...salaried workers, self-employed entrepreneurs, rental property owners, retirees, active investor, students, etc.

As an Enrolled Agent, John can represent you with the IRS when disputes arise or the IRS issues a levy, threatens you or demands immediate payment. We CAN work out a settlement, get penalties reduced or reach an agreement on a payment plan that won't cause additional hardship.

Our Services

We will work with you one-on-one to help you with all your tax needs. Some of our services include:

- Federal and State Income Tax Preparation

- Tax Planning and Consultation

- Small Business and 1099 Tax Advice

- Tax Audit Support and Consultation

- IRS Offers in Compromise & Payment Plans

Ready To Save On Your Taxes?

We spend a great many hours each year researching the latest tax laws and your particular financial situation to find every possible tax break.

We Know Our Clients.

Working with them for many years allows us to learn about their employment, financial and family situation. At tax time we can ask the right questions about everything from college tuition expenses to child care, social security, stock sales, pension withdrawals, medical, costs and other financial factors in their lives.

John Dobbyn, EA (Enrolled Agent)

The Enrolled Agent designation is the highest credential that the IRS awards, and EAs have unlimited practice rights. As an Enrolled Agent, John is required to maintain his credentials by practicing with high ethical standards and staying informed of federal and state tax laws through continuing professional education on an annual basis.

Tax Services: We offer all regular tax services such as federal and state tax returns for personal, corporations, LLCs, partnerships, non-profits, trusts, estates, and gifts, as well as sales tax and use tax reporting and filing.

Tax Audits: We can assist you through the audit process if you have been audited by the IRS or local or state tax agencies, including the Massachusetts Department of Revenue and the tax agencies of other states . We will review the requirements of your tax audit and guide you through the process.

Settle Back Taxes: Do you owe back taxes for previous years? We can help you settle back taxes owed to the IRS or local or state tax agencies

Removal Of A Tax Lien: If you have a federal tax lien, the government has a legal right to your property. We can assist in the discharge of property subordination and withdrawal of the tax lien, which removes the public notice of the tax lien from your property. We can assist in the removal of tax liens from the IRS or local or state tax agencies.

Relief From A Tax Levy: A tax levy is an administrative action by the IRS under statutory authority that allows the agency to seize property to satisfy a tax liability, without going to court. The IRS can levy upon wages, bank accounts, social security payments, accounts receivables, insurance proceeds, real property, and, in some cases, a personal residence. John Dobbyn, EA will review tax levies that have been placed on your assets and provide the best possible resolution for your situation.

Offer In Compromise: An offer in compromise can allow you to settle your tax debts for less than the total amount you owed. John will work with you to create an offer in compromise for debts owed to the IRS or state tax agencies, including Massachusetts Department of Revenue and the Division of Employment & Training

Wage Garnishment: If you have been served with a wage garnishment, your greatest source of income may be at stake. We understand the importance of helping you resolve a wage garnishment case quickly. Wage garnishments may come from the IRS or local or state tax agencies

IRS Tax Appeals: We can help you prepare a Request for Appeals and represent you throughout the appeals process. An appeal can help you resolve a tax dispute without litigation

Collections: If you have received a collection decision from the IRS or Mass. DOR, John can review the information and determine whether a Collections Appeal process is the best course of action.

Offshore Bank Account: Do you have a bank account outside of the United States and are unsure of your filing, reporting and tax obligations? We can assist you in reviewing your accounts to be sure you comply fully with all tax reporting requirements.

Installment Agreement: If you prefer to make your required tax payments using an installment agreement, which will allow you to repay tax debts on a monthly payment plan. We can assist you with installment agreements with the IRS or local or state tax agencies.

Call Us Today For Smarter, More

Practical Tax Solutions! (781) 575-1040

CONTACT US TODAY

Testimonials

See why we are such a top rated tax prep firm in Canton, MA

Audrey T.

John has been doing my taxes for 33 years. He does a great job, is current with all of the tax changes and makes life a whole lot less stressful.

Highly recommend John and his staff for doing your tax returns very professional and friendly would never have anyone else do our returns again thank you.

Outstanding Service at Reasonable Rates

With Year-Round Availability

Let us help you build a long-term tax strategy to maximize your profits.

Schedule An Appointment!

What Happens When A Tax Preparation Firm Uses Every Possible Resource To Analyze Your Tax Planning?

It means you gain substantial tax savings and insight throughout the year and can make smarter decisions such as when to show revenue for your business, when to take retirement distributions and file for Social Security, which year to sell your stocks, how to maximize the tax advantages of your charitable and medical deductions or how much to send in for quarterly estimated taxes.

A More

Meaningful Experience

Tax preparation is about far more than crunching numbers or inputting data. Our team gives you a clear picture of why you are getting a great refund or why you owe the IRS more money each year. You'll understand what went right and what didn't throughout the past year and how you can improve your tax situation going forward. We'll provide a projection of NEXT YEAR and the steps you can take now to reduce your taxes and eliminate penalties.

With the Canton Tax Group at your side, you won't be left in the dark and you'll actually look forward to meeting us again next year.

Call Us Today At (781) 575-1040

Case Study - IRS PROBLEM RESOLUTION

If you're in trouble with the IRS, don't ignore them! Get the professional help you need to resolve the issue and reach a settlement or payment agreement that is fair to both you and the IRS. Maybe our client Joan said it best...

Dear John,

I have to write to you because I am so grateful to you for the tax work you did at my request, for a family member.

Several years ago I volunteered to help take care of a family member who had been diagnosed with an acute and terminal illness.

Shortly after taking on this responsibility it because clear that this individual had not been managing well for some time both physically and financially.

I realized that they had not filed their taxes for several years after a lifetime of hard work and financial responsibility.

I contacted the State Dept of Revenue and the IRS and was overwhelmed by the amount of money that was owed because of late fees and penalties. I didn't know what to do and I didn't know where to turn.

Thankfully another family recommended that I contact you.

You worked tirelessly with the IRS and the Revenue Dept. Your knowledge and expertise saved this person from losing their home and their income. Your efforts have allowed them to live out the end of their life with dignity. I can never adequately thank you for for all you have done; you are a miracle worker.

Your work saved the financial portion of this person's life and turned what I thought was a hopeless situation into a positive experience. I learned from this that no matter how dire a situation may seem that with the assistance of the correct professional that a successful resolution can be reached.

Also you charged a very reasonable fee which was only a fraction of what a Tax Attorney would have billed me. I recommend you to everyone because I know first hand that you excel at what you do. I truly appreciate your help.

Sincerely,

Joan P.

Looking for a more Personal... and Professional... Relationship THAN YOU CAN EVER GET WITH A NATIONAL CHAIN OF TAX PREPARERS?

Canton Tax Group is based right in Canton, MA and our office is open all year 'round. Whether you just have a quick question or you need a one-on-one meting to discuss some important tax issues, we are only a phone call away. And yes... clients do have John's direct cell phone number!

CONTACT US NOW

Myth-Filing for Tax Extensions Increases Audit Chances

Does the IRS become suspicious when you ask for more time to file your taxes? Absolutely not. Businesses have hundreds of legitimate reasons why they can't meet the April 15th deadline. Filing for an extension shows that employers are committed to filing their taxes accurately, which actually decreases the chances of an audit.

The truth is that over 10 million businesses and taxpayers are granted six-month filing extensions every year. This actually helps the IRS during the peak season and there is absolutely no evidence of late filers being audited more often. This myth is 100% busted.

MEET OUR TEAM

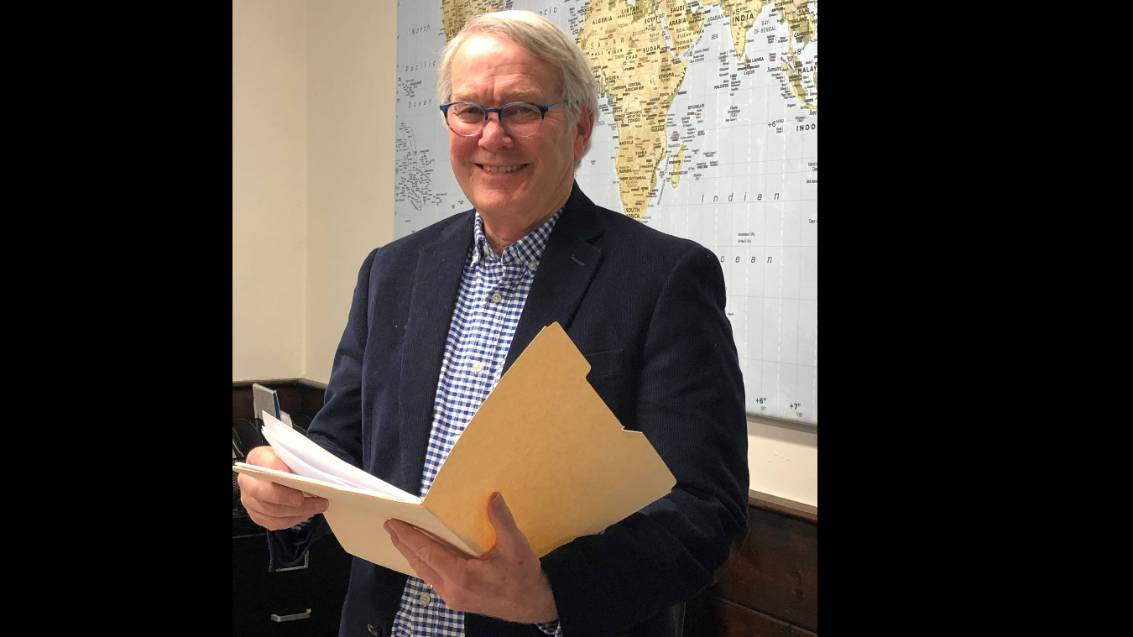

John Dobbyn, EA

Owner

John is an Enrolled Agent with decades of experience preparing tax returns for a wide variety of clients. He has a BS from Boston College and a MBA from Suffork University, As an EA, he has proven his expertise through rigorous testing with the IRS and is committed to many hours of Continuing Professional Education each year. He is authorized to represent clients in tax appeals, disputes, and collection issues with the IRS and the State of Massachusetts. DOR.

Linda Dobbyn

Office Manager

Linda Dobbyn, Office Manager, Retired Math Teacher and now works with the Canton Tax Group team to help make certain that the office runs smoothly during tax season.

Bonnie Espino

Tax Preparer

Bonnie Espino has an extensive background in finance, investment and insurance. Her professional experience includes a variety of positions at major corporations (including Liberty Mutual) as well as a local investment advisory group. She joined Canton Tax Group on a Part time basis in 2017 and has been a valuable contributor to the firm since that time. In addition to learning by experience of Tax preparing tax returns of increasing complexity, she has also successfully completed the Tax Preparer Training Course at

Liberty Tax.

Jenna Dobbyn

Tax Preparer

Jenna is a full-time IT Project Manager for a Fortune 500 company and has an MBA from Alvernia University. She has developed her expertise in Tax Preparation by working nights and weekends for Canton Tax Group since 2018.

See Why Our Clients Rave About Our Tax Service

Offer In Compromise:

An offer in compromise can allow you to settle your tax debts for less than the total amount you owed. John will work with you to create an offer in compromise for debts owed to the IRS or state tax agencies, including Massachusetts Department of Revenue and the Division of Employment & Training.

Call Us Today For A Free Quote (781) 575-1040

Frequently Asked Questions

Why can't I just do my own taxes?

Federal and Massachusetts income taxes are complicated. You're great at what you do (or did) for work, but you probably don't have time to stay on top of the ever- changing World of Federal and State taxes and take advantage of all the credits and deductions that a tax professional has learned about from preparing thousands of returns over many decades in business.

Why don't I just call one of the "BIG CHAIN" tax firms

The ads on TV make it look so easy, right? The truth is that if you have any complicating factors at all, you'll be charged far more than the ads suggest... and certainly much more than you would pay to Canton Tax Group.

Most important, of course, is the fact that we are a local, professional firm with a solid commitment to our clients and to the entire community and we have a great reputation for competence and fairness that is so important to us.

What will it cost and how can I make an appointment?

We can usually give you a very reasonable estimate over the phone once we have an idea of your tax situation. Just contact us by calling number:

Easy To Find & Convenient Hours

WHERE ARE WE

Opening Hours

Monday 8:30AM-6:30PM

Tuesday 8:30AM-6:30PM

Wednesday 8:30AM-6:30PM

Thursday 8:30AM-6:30PM

Friday 8:30AM-6:30PM

Saturday 9AM-4PM

Sunday As Required

1. No mobile opt-in will be shared with third parties for marketing purposes.

2. Canton Tax Group will occasionally send text messages to current and prospective clients. These messages will sometimes include promotional messages expected to average once every two months. Message and data rates may apply. Recipients will be able to opt out at any time by replying with the message "OPT OUT."

CONTACT US

You can contact us at our address below, or you could fill up the contat form and we will get back to you as soon as we could.

![]() Call Us On: (781) 575-1040

Call Us On: (781) 575-1040

![]() Email Us at dobbynj@aol.com

Email Us at dobbynj@aol.com

By checking this box, you agree to receive text messages from (your company name here), including reminders, services, promotions, and updates. Message frequency may vary. Standard message and data rates may apply. You can opt out of receiving messages at any time by replying “STOP”. For help, reply “HELP” or contact us atdobbynj@aol.com / (781) 575-1040. For more information, please review our Terms and Conditions and Privacy Policy.

SUBMIT FORM